Newsletters

- Home

- Newsletters

Newsletters

Will you outlive your retirement income? Are your financial expectations for the coming year realistic?

Our financial newsletters are designed to provide helpful information on a wide variety of financial topics. Simply click on one of the newsletter topics below to read the article in its entirety.

Unpacking the Inflation Reduction Act: What’s in It?

The Inflation Reduction Act (IRA), signed into law on August 16, 2022, is a package of climate, energy, health-care, and tax legislation. It authorizes about $440 billion in new spending and will generate an estimated $740 billion in revenue and savings, reducing the deficit by around $300 billion over a decade.1

What the Red-Hot Job Market Means for Workers

The COVID-19 pandemic kicked off a severe labor shortage — and quite possibly the most worker-friendly job market in many years. Unpredictable demand shifts exposed pre-existing mismatches between the knowledge and skills of available workers and the tasks for which they are needed. The sheer number of available jobs has also been running far above the number of unemployed job seekers. For example, employers reported 11.4 million job openings in April 2022, while there were only 6.0 million unemployed persons.1

Preparing for a Natural Disaster

Most areas in the United States are susceptible to some form of natural disaster, whether it’s a wildfire, tornado, hurricane, earthquake, or flood. A severe storm or other catastrophic event often strikes with little warning, can result in costly damage to your home, and puts your family’s safety at risk. Being prepared may help you make it through a natural disaster safely.

How Life Insurance Could Help Mitigate Taxes in Retirement

Higher taxes could follow in the wake of soaring government spending on pandemic relief measures — a likelihood that shines a new light on the tax advantages of life insurance. Permanent life insurance offers a tax-free death benefit, and a portion of each premium goes into a cash-value account that accumulates on a tax-deferred basis. The policy owner may also access the cash value, if needed, without triggering income taxes.

Diversifying Your Portfolio with International Flair

Global economic growth is projected to drop from an estimated 6.1% rate in 2021 to 3.2% in 2022, as the world grapples with repercussions from the Russia-Ukraine war and ever-changing conditions wrought by the pandemic. Growth forecasts of 2.3% for the United States and 2.6% for the euro area in 2022 (down from 5.7% and 5.4%, respectively, in 2021) reflect the prospect of supply constraints along with rising inflation and interest rates. China’s growth is projected to slow to 3.3% in 2022 from 8.1% in 2021 due to its restrictive zero-COVID strategy and languishing real estate sector.1

Is the U.S. Economy in a Recession?

In an early July poll, 58% of Americans said they thought the U.S. economy was in a recession, up from 53% in June and 48% in May.1 Yet many economic indicators, notably employment, remain strong. The current situation is unusual, and there is little consensus among economists as to whether a recession has begun or may be coming soon.2

Inflation Protection for Investment Dollars

For the 12-month period ending in June 2022, the Consumer Price Index for All Urban Consumers (CPI-U) — the most widely used measure of inflation — increased 9.1%, the fastest pace in more than 40 years.1 The rate may trend downward as the Federal Reserve raises interest rates and supply-chain issues improve. But inflation is likely to be relatively high for some time.

Life Insurance Living Benefits

When thinking about life insurance, you might focus on the death benefit that can be used for income replacement, business continuation, and estate preservation. But life insurance policies may include other provisions that allow you to access some or all of the death benefit while you are living. These features are often referred to as living benefits, which are usually offered as optional add-ons called riders.

Uncle Sam Wants to Know About Your Gig Income

If you earn money through an app or online digital platform, you may be affected by a tax reporting change that took effect on January 1, 2022. A provision of the 2021 American Rescue Plan requires third-party payment processors to report business transactions totaling over $600 per year by issuing a Form 1099-K to the taxpayer and the IRS. In prior years, the reporting threshold was much higher (200 business transactions and $20,000).

Six Steps to Starting a New Business

An extraordinary number of new business applications — nearly 5.4 million — were filed in 2021, far surpassing the previous record of 4.4 million set in 2020.1 Although some of these start-ups will replace businesses that closed earlier in the pandemic, it appears that many Americans reassessed their careers and were inspired to launch brand-new ventures of their own. Some people took the leap into self-employment after losing their former jobs, while others gave up stable paychecks to take a chance on their dreams.

Sticker Shock Is No Joke for Car Buyers

The average price for a new vehicle reached $47,077 in December 2021, which amounts to a 14% price hike in just one year. Perhaps more startling, the average price paid for a nonluxury vehicle was $900 above the Manufacturer’s Suggested Retail Price (MSRP), otherwise known as the sticker price.1

Should You Consider Tapping the Equity in Your Home?

With home values skyrocketing recently, your home may be one of your largest assets. Using home equity to help finance other financial objectives is a strategy many people consider, but before doing so be sure you understand the risks as well as the potential benefits.

A Wealth of Information: How to Read a Mutual Fund Prospectus

With more than 7,400 mutual funds to consider in the United States alone, some investors may feel overwhelmed by the thought of deciding which ones to select for their portfolios. At the same time, most mutual fund–owning households base their purchase decisions on these measures: historical performance (94%), investment objectives and risk potential (91%), and fees and expenses (90%).1

WEP and GPO Can Reduce Social Security Benefits

The windfall elimination provision (WEP) and the government pension offset (GPO) were intended to correct a perceived unfair advantage in calculating Social Security benefits for people who earned a pension in noncovered employment — i.e., while not paying Social Security payroll taxes. In December 2020 (most recent data available), the WEP affected more than 1.9 million beneficiaries, primarily retired workers, while the GPO affected more than 700,000 spouses and widow(er)s.1

How Long Should You Keep Financial Records?

With tax season in the rearview mirror, this might be a good time to organize your records. Here are some guidelines to help decide what to keep and what to discard. Use a shredder when discarding paper records containing confidential information, and be sure that any electronic records are removed through a secure deletion process.

Avoiding Probate

Probate is the process of proving the validity of a will and supervising the administration of an estate, usually in the probate court. State law governs the proceedings in the probate court, so the process can vary from state to state. Supervising the administration of an estate can result in additional expense, unwanted publicity, and delays in the distribution of estate assets for a year or longer, which is why planning to avoid the probate process may be beneficial.

What’s Your Retirement Dream Elevator Pitch?

Imagine stepping into an elevator and realizing that you’re about to spend the 30-second ride with someone who could make your retirement dreams come true — if only you could explain them before the doors open again. How would you summarize your financial situation, outlook, aspirations, and plans if you had 30 seconds to make an “elevator pitch” about achieving one of your most important goals?

Are You Ready to Cancel Your Cable TV?

An explosion in the number and variety of streaming services, coupled with the high cost of cable and satellite television packages, might have you wondering whether it’s time to cut the cord. But streaming costs money, too, and you may have to subscribe to multiple services to access all your favorite programs. You might also need to buy a streaming device and pay for a pricey high-speed Internet connection, if you don’t already have one, to avoid annoying interruptions.

Where to Look for Lost and Forgotten Money

If you get a call or text regarding unclaimed property that may belong to you, it’s probably from scammers trying to collect information about you and your finances. Many people lose track of old accounts or never receive checks mailed to an old address. However, you don’t need to pay anyone to retrieve unclaimed property that is rightfully yours, and it’s not difficult to search for it yourself — if you know where to look.

Consider a Bond Ladder for Rising Interest Rates

After dropping the benchmark federal funds rate to a range of 0%–0.25% early in the pandemic, the Federal Open Market Committee of the Federal Reserve has begun raising the rate aggressively in response to high inflation and a stronger economy. Following an initial 0.25% increase in March 2022 and a 0.5% increase in May, the Committee raised the rate by 0.75% at its June and July meetings — the largest increases since 1994 — to reach a target range of 2.25%–2.5%. June projections indicated the rate could rise to a range of 3.25%–3.5% by the end of 2022, with an additional one or two 0.25-percentage-point increases in 2023.1

Working While Receiving Social Security Benefits

The COVID-19 recession and the continuing pandemic pushed many older workers into retirement earlier than they had anticipated. A little more than 50% of Americans age 55 and older said they were retired in Q3 2021, up from about 48% two years earlier, before the pandemic.1

Baseball Lessons That Might Help Change Up Your Finances

Baseball stadiums are filled with optimists. Fans start each new season with the hope that even if last year ended badly, this year could finally be the year. After all, teams rally mid-season, curses are broken, and even underdogs sometimes make it to the World Series. As Yogi Berra famously put it, “It ain’t over till it’s over.”1 Here are a few lessons from America’s pastime that might inspire you to take a fresh look at your finances.

Why Small Businesses Should Pay Attention to Accessibility

The Americans with Disabilities Act (ADA), which passed more than 30 years ago, made it illegal to deny job opportunities to people based on their disabilities, mandated “reasonable accommodations” to make buildings accessible, and required most private businesses to offer equal service to disabled customers. About 61 million people in the United States — one in every four adults — live with a disability.1

Food Inflation: What’s Behind It and How to Cope

As measured by the Consumer Price Index for food at home, grocery prices increased 3.4% in 2020, a faster rate than the 20-year historical average of 2.4%.1 More recently, food inflation accelerated by 6.5% during the 12 months ending in December 2021, while prices for the category that includes meat, poultry, fish, and eggs spiked 12.5%.2

ETFs Are Gaining on Mutual Funds: Here's Why

Investor demand for exchange-traded funds (ETFs) has increased over the last decade due to some attractive features that set them apart from mutual funds. At the end of 2021, almost $7.2 trillion was invested in more than 2,500 ETFs. This is equivalent to 27% of the assets invested in mutual funds, up from just 9% in 2011.1

Splurge or Save? Making the Most of Your Income Tax Refund

The IRS issued more than 128 million income tax refunds for the 2020 filing season, putting $355.3 billion into the hands of U.S. consumers.1 For most recipients, such a sudden influx of cash prompts an important question: What’s the best way to use the money?

What's the Difference Between Medicare and Medicaid?

It’s easy to confuse Medicare and Medicaid, because they have similar names and are both government programs that pay for health care. But there are important differences between the programs. Medicare is generally for older people, while Medicaid is for people with limited income and resources.

Flood Insurance: Be Prepared for Rising Waters and Changing Rates

Water damage to your home from a leaking pipe, a broken dishwasher, or a hole in your roof — water that comes from the top down — is typically covered by your homeowners insurance policy (up to your policy limits). However, damage from water that enters from the ground up is excluded from most homeowners policies and requires a separate flood insurance policy. To be considered a flood for insurance purposes, water must cover at least two acres or affect two properties. Typically, there is a 30-day waiting period before flood coverage goes into effect, so property owners should not wait until there is an imminent threat to buy flood insurance.

Creating Your Own “Operation London Bridge”

“London Bridge is down.” On September 8, 2022, those words were reportedly used to launch what were arguably the most complex end-of-life proceedings the world had ever witnessed: the funeral arrangements for Queen Elizabeth II. The plan, known as Operation London Bridge, laid out in exacting detail how the ensuing days would unfold. Although most families don’t need a playbook as intricate as the royals, a comprehensive end-of-life plan can significantly ease the burden on family members during a highly emotional period.

When Should Young Adults Start Investing for Retirement?

As young adults embark on their first real job, get married, or start a family, retirement might be the last thing on their minds. Even so, they might want to make it a financial priority. In preparing for retirement, the best time to start investing is now — for two key reasons: compounding and tax management.

The Inflation Experience Is Painful — and Personal

Inflation is a sustained increase in prices that reduces the purchasing power of your money over time. According to the Consumer Price Index (CPI), inflation peaked at an annual rate of 9.1% in June 2022, the fastest pace since 1981, before ticking down to 6.5% in December.1

SECURE 2.0 Aims to Brighten the Future for Retirement Savers

The $1.7 trillion appropriations bill passed by Congress at the end of last year included some notable provisions affecting workplace retirement plans and IRAs. Dubbed the SECURE 2.0 Act of 2022, the new legislation builds on the sweeping Setting Every Community Up for Retirement Enhancement Act that was passed in 2019.

Balancing Stocks and Bonds in One Fund

Maintaining an appropriate balance of stocks and bonds is one of the most fundamental concepts in constructing an investment portfolio. Stocks provide greater growth potential with higher risk and relatively low income; bonds tend to be more stable, with modest potential for growth and higher income. Together, they may result in a less volatile portfolio that might not grow as fast as a stock-only portfolio during a rising market, but may not lose as much during a market downturn.

Fixed for Life: What Can an Annuity Do for You?

With stock and bond markets both faltering over the past year, it’s easy to see why more near retirees have a newfound appreciation for fixed annuities — insurance contracts that guarantee a specified rate of return. A fixed annuity maintains its value regardless of market conditions, and yields on these products have risen in response to the higher interest-rate environment.

Three Ways to Help Simplify Your Finances

Over time, finances tend to get complicated, especially when you’re juggling multiple goals and accounts. Simplifying your finances requires a bit of effort up front, but making just a few changes may help free up more time to focus on your financial priorities.

IRA Strategies: After-Tax Money and the Pro-Rata Rule

If you own an IRA and all your contributions were made with pre-tax funds, your withdrawals will be taxed as ordinary income in the year of the distribution. But if you also made after-tax contributions, determining the taxable amount of your distributions may not be that simple, especially if you have multiple IRAs. In that case, the pro-rata rule must be used to determine the percentage of each distribution that is taxable.

Small Businesses Should Prepare for Stronger Tax Enforcement

The Inflation Reduction Act of 2022 is providing the IRS with an influx of about $80 billion to modernize outdated technology and rebuild a depleted workforce, which is expected to improve enforcement to the tune of about $200 billion over a decade. Treasury Secretary Janet Yellen directed the agency not to use additional resources to increase audit rates for taxpayers making under $400,000 a year, but the tax returns of high-earning business owners are likely to face more scrutiny than they have in years past.1

Is the Yield Curve Signaling a Recession?

Long-term bonds generally provide higher yields than short-term bonds, because investors demand higher returns to compensate for the risk of lending money over a longer period. Occasionally, however, this relationship flips, and investors are willing to accept lower yields in return for the relative safety of longer-term bonds. This is called a yield curve inversion, because a graph showing bond yields in relation to maturity is essentially turned upside down (see chart).

Three Stretch IRA Alternatives

The passage of the SECURE Act in 2019 effectively eliminated the stretch IRA, an estate planning strategy that allowed an inherited IRA to continue growing tax deferred, potentially for decades. Most nonspouse beneficiaries, including children and grandchildren, can no longer stretch distributions over their lifetimes. Moreover, proposed IRS regulations require most designated beneficiaries to take annual required minimum distributions (RMDs) within the 10-year distribution period if the original account owner died on or after his or her required beginning date. This shorter distribution period could result in unanticipated and potentially large tax bills for nonspouse beneficiaries who inherit high-value IRAs.

A 529 Plan Can Help Jump-Start Your College Fund

Busy, cash-strapped parents might welcome all the help they can get when saving for college. Building a college fund, even a small one, can help families feel more in control and less stressed during the college research and admission process. Think of a college fund as a down payment. Then at college time, it can be supplemented by financial aid (grants, scholarships, loans, and work-study), current income, and student funds. A good benchmark is to try and save at least 50% of your child’s projected college costs, but any amount is better than nothing.

Tips for Safe Online Shopping

According to the National Retail Federation, online sales accounted for over $1 trillion of total U.S. retail sales in 2021.1 Online shopping is especially popular during the holiday season, enabling you to avoid the crowds and conveniently purchase gifts using your smartphone or computer. Unfortunately, the popularity of online shopping also means that cyber criminals and online scams are more prevalent than ever. Here are some tips to help protect yourself when shopping online.

Naming a Trusted Contact

When you open an account or update an existing account at a brokerage or a financial firm, you may be asked if you want to designate a “trusted contact.” This individual may be contacted in certain situations, such as when financial exploitation is suspected or there are other concerns about your health, welfare, or whereabouts. Naming a trusted contact is optional but may help protect your account assets.

’Tis the Season for Tax-Friendly Giving Strategies

You may donate money to charitable organizations throughout the year, for no other reason than your heart-felt desire to support causes that you care about. But if philanthropy is important to you, keep in mind that the associated tax breaks could potentially increase your ability to give. You might consider a more strategic approach to charitable giving, possibly as part of your year-end tax planning.

Is It Time to Buy an Electric Vehicle?

Record-breaking fuel prices may have you thinking about buying an electric vehicle sooner rather than later. All electric vehicles (EVs) or plug-in electric vehicles (PEVs), as they’re also called, run on electric energy stored in a rechargeable battery rather than on fuel. Plug-in hybrid electric vehicles (PHEVs) that can run on either type of power are also popular. The market is evolving quickly: 126 additional hybrid and EV models were introduced between 2020 and 2021, and U.S. sales nearly doubled.1

IRA Distributions Can Benefit Your Favorite Cause … and Your Tax Bill

The Tax Cuts and Jobs Act nearly doubled the standard deduction beginning in 2018 and indexed it annually for inflation through 2025 ($12,950 for single taxpayers and $25,900 for joint filers in 2022; $13,850 and $27,700 in 2023). The result was a dramatic reduction in the number of filers who itemize — from 30.6% of all returns in 2017 to 9.5% in 2020.1

Talk About These Money Matters Before the Wedding

If predictions come to pass, 2022 will be the biggest year for weddings since 1984, with the culmination of many postponed or delayed celebrations in addition to regularly scheduled events. There are expected to be about 2.5 million weddings in the United States in 2022, according to the Wedding Report, an industry trade group, up from 1.9 million in 2021. There were roughly 2.1 million weddings each year between 2009 and 2019, before the pandemic-shortened wedding season of 2020 (1.3 million).1

Fraudsters and Scammers Pocket Nearly $6 Billion in 2021

According to the Federal Trade Commission (FTC), 2.8 million people lost $5.8 billion to fraud in 2021, a 70% increase in losses over 2020. Imposter scams topped the list of fraud types, surpassing others by a huge financial margin, followed by online shopping scams.1

What Does a Strong Dollar Mean for the U.S. Economy?

In late September 2022, the U.S. dollar hit a 20-year high in an index that measures its value against six major currencies: the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc. At the same time, a broader inflation-adjusted index that captures a basket of 26 foreign currencies reached its highest level since 1985. Both indexes eased slightly but remained near their highs in October.1–2

New Life for Your Old Insurance Policy

Life insurance can serve many valuable purposes. However, later in life — when your children have grown, you’ve retired, or you’ve paid off your mortgage — you may no longer think you need to keep your coverage, or perhaps your coverage has become too expensive. You might be tempted to abandon the policy or surrender your life insurance coverage, but there are other alternatives to consider.

Virtual Health Care Is Here to Stay

The use of telehealth skyrocketed early in the COVID-19 pandemic, with the number of remote office visits and outpatient services 78 times higher in April 2020 than in February 2020. Usage has stabilized since that extraordinary rise, but as of early 2021 remained 38 times higher than the pre-pandemic level.1

How Funding an HSA Could Help Strengthen Your Retirement Strategy

By one estimate, the typical 65-year-old couple who retired in 2021 could spend as much as $296,000 on health-care expenses in retirement. This figure includes lifetime premiums for Medicare, supplemental insurance, deductibles, coinsurance, and other out-of-pocket costs for medical care and prescription drugs.1

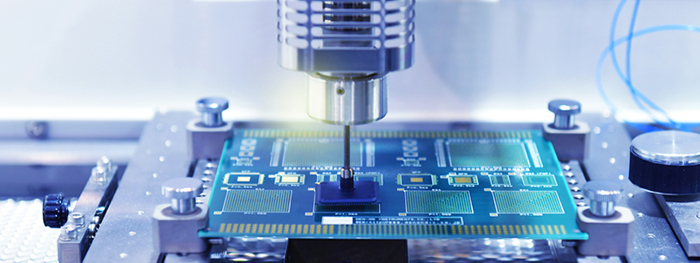

CHIPS and Science Act Aims to Preserve U.S. Technology Edge

The CHIPS and Science Act of 2022, signed into law on August 9, is bipartisan legislation that provides more than $50 billion in direct financial assistance for companies to increase U.S.-based semiconductor design, research, and manufacturing capabilities. In addition, the legislation authorizes nearly $170 billion in federal funding over five years for research and development (R&D) programs in strategic areas of science and technology, such as artificial intelligence, quantum computing, wireless communications, clean energy, and precision agriculture.

Passive, Active, or Both?

Index funds, which try to match the performance of a particular market index, have drawn increasing interest from investors, but traditional actively managed funds still hold more assets (see chart). There is ongoing discussion in the financial media about which approach is most effective, but there may be good reasons to hold both in a well-diversified portfolio. Here are some pros and cons to consider.

How Much Life Insurance Do You Need?

Throughout your life, your financial needs will change, and life insurance can help you meet some of those needs. But how much life insurance do you need? There are a number of approaches to help determine how much life insurance you should have. Here are three of those methods.

Building Financial Resilience

Inflation, roller-coaster markets, global events, and life circumstances can test anyone’s fortitude. You may not feel ready to handle these pressure-filled times and might worry about the potential effects on your financial well-being. Fortunately, you can take steps to build the resilience to help handle the turbulence and hopefully emerge even stronger.

Donor-Advised Funds Combine Charitable Impact with Tax Benefits

A donor-advised fund (DAF) is a charitable account offered by sponsors such as financial institutions, community foundations, universities, and fraternal or religious organizations. Donors who itemize deductions on their federal income tax returns can write off DAF contributions in the year they are made, then gift funds later to the charities they want to support. DAF contributions are irrevocable, which means the donor gives the sponsor legal control, while retaining advisory privileges with respect to the distribution of funds and the investment of assets.

Small Businesses Are Short-Staffed and Overwhelmed

COVID-19 kicked off a severe labor shortage — and the most challenging hiring conditions for small businesses in many years. Many owners have had to turn away orders (and revenue), disappoint customers, or work 80-hour weeks to help fill the labor gap, none of which is likely to be sustainable.