The Inflation Experience Is Painful — and Personal

Inflation is a sustained increase in prices that reduces the purchasing power of your money over time. According to the Consumer Price Index (CPI), inflation peaked at an annual rate of 9.1% in June 2022, the fastest pace since 1981, before ticking down to 6.5% in December.1

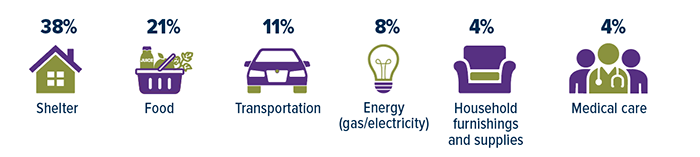

The CPI tracks changes in the cost of a market basket of goods and services purchased by consumers. Items are sorted into more than 200 categories that are weighted according to their “relative importance,” a ratio that represents how consumers divide up their spending, on average. Basic needs such as shelter (33%), food (14%), energy (8%), transportation (8%), and medical care (7%) account for more than two-thirds of consumer expenditures.

The recent bout of inflation has been driven in large part by steep price increases for essentials, which means it’s hitting many U.S. households where it hurts. Even so, some consumers feel the sting of inflation more than others.

The extent to which you experience inflation depends a lot on your spending patterns, which are influenced by where you live as well as your age, income, family size, and lifestyle. In effect, your personal inflation rate could be significantly higher or lower than the average headline inflation rate captured in the CPI. Consider the following examples.

- In December 2022, the 12-month increase in the cost of shelter was 7.5%.2 Shelter carries the most weight of any category in the CPI, which made fast-rising home prices and rents a top driver of inflation in 2022. However, a homeowner with a fixed mortgage is generally insulated from these rising costs and might even benefit financially from home-equity gains. Meanwhile, a first-time homebuyer, or a renter who signs a new lease, is likely to feel the full impact of these hefty price increases.

Top Inflation Drivers

Contribution to the 12-month, 6.5% increase in consumer prices, December 2022

Source: U.S. Bureau of Labor Statistics, 2023

- Gasoline surged 59.9% during the 12 months ended in June 2022, before falling in the second half of the year.3 Individuals who rarely drive, possibly because they are retired or work remotely, might have been able to shrug off the price spike caused by the Russia-Ukraine war. But for drivers with long commutes, filling up the gas tank regularly might have put a sizable dent in their household’s finances, in some cases forcing them to cut back on other purchases.

- Food prices rose 10.4% over the same 12-month period, a trend that clearly affects everyone.4 But rising food costs tend to put more pressure on the budgets of lower-income households because they spend a greater share of their income on necessities and typically have smaller financial cushions. Plus, shoppers can’t easily switch to lower-cost options if they are already relying on them.5

1–4) U.S. Bureau of Labor Statistics, 2023

5) Federal Reserve, 2022

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Solutions, Inc.