How Funding an HSA Could Help Strengthen Your Retirement Strategy

By one estimate, the typical 65-year-old couple who retired in 2021 could spend as much as $296,000 on health-care expenses in retirement. This figure includes lifetime premiums for Medicare, supplemental insurance, deductibles, coinsurance, and other out-of-pocket costs for medical care and prescription drugs.1

The primary purpose of a health savings account (HSA) is for workers to set aside pre-tax income to pay current and future medical expenses not covered by health insurance. This is why HSAs are sometimes called Medical IRAs. They incentivize saving with three powerful tax advantages: (1) the dollars you contribute are deducted from your adjusted gross income, (2) investment earnings compound tax-free inside the HSA, and (3) withdrawals are untaxed if the money is spent on qualified health-care expenses. (Depending on the state, HSA contributions and earnings may or may not be subject to state taxes.)

Another benefit is that account funds not needed for health expenses are available for any other purpose after you reach age 65. When HSA money is spent on anything other than qualified medical expenses, withdrawals are taxed as ordinary income, but they don’t incur the 20% penalty that applies to taxpayers under age 65.

Eligibility and Contribution Limits

To be eligible to establish or contribute to an HSA in 2023, you must be enrolled in a qualifying high-deductible health plan (an HDHP with a deductible of at least $1,500 for individuals, $3,000 for families).

Qualifying HDHPs also have out-of-pocket maximums, above which the insurer pays all costs. In 2023, the upper limit is $7,500 for individual coverage ($15,000 for family coverage), but plans may have lower caps. This feature could help you budget accordingly for a worst-case scenario.

Premiums are typically lower for HDHPs than they are for traditional health maintenance organization (HMO) and preferred provider organization (PPO) health plans; members usually pay more upfront for services such as physician visits, surgical treatment, and prescriptions, but they typically receive the insurer’s negotiated discounts.

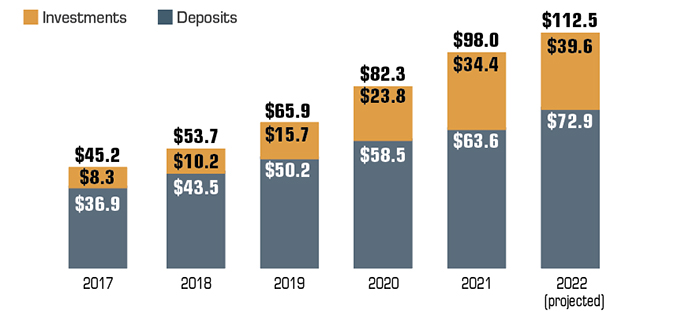

Health Savings Account Assets (in billions)

Source: Devenir HSA Research Report, 2021

Contribution Rules

The HSA contribution limit is $3,850 if you have individual coverage or $7,750 if you have family coverage in 2023. An additional $1,000 can be contributed starting the year you turn 55. Some employers make an annual contribution to employees’ HSAs.

Once in your lifetime, you can make a tax-free rollover from your IRA to an HSA (subject to maximum annual contribution limits), as long as you have HSA-eligible HDHP coverage. Transferring money to an HSA avoids the tax bill and potential penalty you would have if you withdrew money from a traditional IRA to pay medical bills. However, you must continue to be enrolled in an HSA-eligible HDHP for 12 months after the transfer or the IRS will consider it to be a taxable IRA distribution.

Account Management

A well-funded and carefully managed HSA could play an important role in your long-term retirement strategy. Although HSA funds cannot be used to pay regular health plan premiums, they can be used for Medicare premiums and qualified long-term care insurance premiums and services during retirement. Once you sign up for Medicare, however, you can no longer contribute to an HSA.

If you can afford to fund your HSA generously while working, some of those dollars could be left untouched to compound on a tax-deferred basis for a number of years. When HSA balances reach a certain threshold, the money can be steered into a paired account with investment options similar to those typically offered in a workplace 401(k). All investing involves risk, including the loss of principal, and there is no guarantee that any investment strategy will be successful.

You could also pay current medical expenses out of pocket and preserve accumulated HSA assets for use during retirement. But save your receipts — you may want to reimburse yourself down the road if you have an unexpected cash crunch.

1) Employee Benefit Research Institute, 2022

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2022 Broadridge Financial Solutions, Inc.