Key Retirement and Tax Numbers for 2022

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2022.

Estate, Gift, and Generation-Skipping Transfer Tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2022 is $16,000, up from $15,000 in 2021.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2022 is $12,060,000, up from $11,700,000 in 2021.

Standard Deduction

Taxpayers can generally choose to itemize certain deductions or claim a standard deduction on their federal income tax returns. In 2022, the standard deduction is:

- $12,950 (up from $12,550 in 2021) for single filers or married individuals filing separate returns

- $25,900 (up from $25,100 in 2021) for married joint filers

- $19,400 (up from $18,800 in 2021) for heads of household

The additional standard deduction amount for the blind and those age 65 or older in 2022 is:

- $1,750 (up from $1,700 in 2021) for single filers and heads of household

- $1,400 (up from $1,350 in 2021) for all other filing statuses

Special rules apply for those who can be claimed as a dependent by another taxpayer.

IRAs

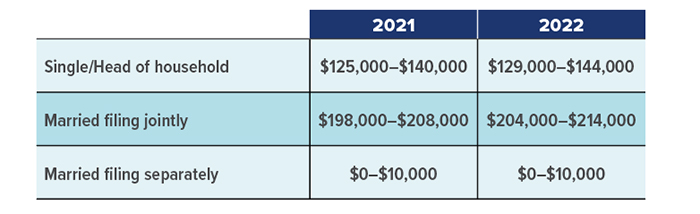

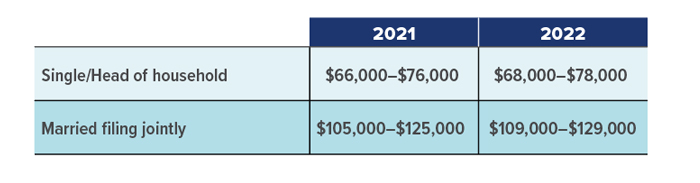

The combined annual limit on contributions to traditional and Roth IRAs is $6,000 in 2022 (the same as in 2021), with individuals age 50 or older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see chart). For individuals who are covered by a workplace retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see chart). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

MAGI Ranges: Contributions to a Roth IRA

MAGI Ranges: Deductible Contributions to a Traditional IRA

Note: The 2022 phaseout range is $204,000–$214,000 (up from $198,000–$208,000 in 2021) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0–$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

Note: The 2022 phaseout range is $204,000–$214,000 (up from $198,000–$208,000 in 2021) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0–$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

Employer Retirement Plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $20,500 in compensation in 2022 (up from $19,500 in 2021); employees age 50 or older can defer up to an additional $6,500 in 2022 (the same as in 2021).

- Employees participating in a SIMPLE retirement plan can defer up to $14,000 in 2022 (up from $13,500 in 2021), and employees age 50 or older can defer up to an additional $3,000 in 2022 (the same as in 2021).

Kiddie Tax: Child’s Unearned Income

Under the kiddie tax, a child’s unearned income above $2,300 in 2022 (up from $2,200 in 2021) is taxed using the parents’ tax rates.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2022 Broadridge Financial Solutions, Inc.